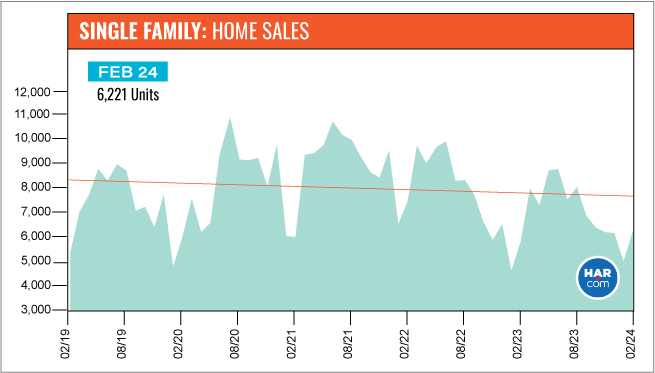

Houston's real estate market experienced a notable surge in activity during February, signaling promising developments for the upcoming spring homebuying season. The latest report from the Houston Association of Realtors (HAR) indicates a 7.6 percent increase in single-family home sales across the Greater Houston area, marking the third such rise in the past year. Compared to February 2023, the Houston Multiple Listing Service (MLS) recorded a significant uptick in sales, with 6,221 units sold, up from 5,781. Additionally, the inventory of available homes expanded, with the months supply climbing from 2.5 to 3.4.

Of particular note is the robust performance of the luxury market segment, where homes priced at $1 million or more saw a remarkable 48.0 percent year-over-year surge in sales. Following closely behind, homes priced between $500,000 and $1 million experienced an 18.3 percent increase in sales. However, homes within the $150,000 to $250,000 price range witnessed a decline in sales. Meanwhile, the rental market for single-family homes remained strong throughout February, with further details to be revealed in HAR's forthcoming February 2024 Rental Home Update on March 20.

Thomas Mouton, Chair of HAR, expressed optimism regarding the market's trajectory, noting that pent-up demand and a willingness to set aside concerns about interest rates are driving consumers back into the market. This resurgence in activity, coupled with slight price appreciation and a growing inventory, presents opportunities for both buyers and sellers in the marketplace.

In terms of pricing, the average price of single-family homes in the Greater Houston area saw a 4.1 percent increase to $400,252, while the median price rose by 3.0 percent to $329,686. Overall, these developments paint a positive picture for Houston's real estate landscape, with signs pointing towards continued momentum in the months ahead.

In February, the Houston real estate market continued its positive trend, marking the second consecutive month of growth in single-family home sales, which increased by 7.6 percent compared to the previous year. This follows a notable 8.9 percent increase in sales observed in the previous month.

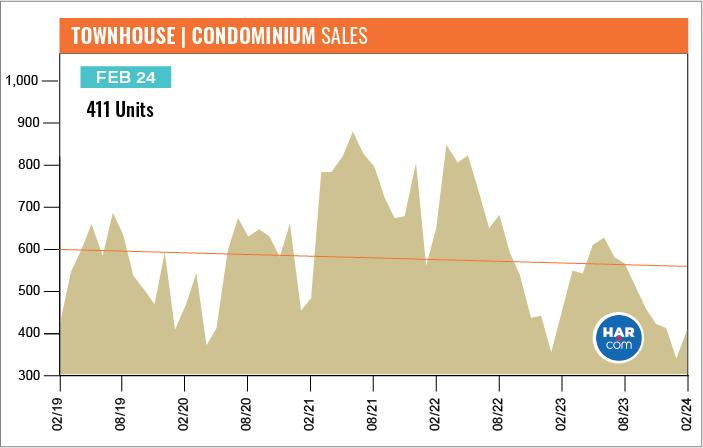

Alongside the rise in single-family home sales, the overall property market also saw an uptick, with total property sales climbing by 7.0 percent and total dollar volume increasing by 11.8 percent, reaching $2.9 billion compared to $2.6 billion previously. Additionally, pending single-family home sales experienced a substantial increase of 12.9 percent. Active listings, representing the total number of available properties, surged by 22.0 percent compared to the previous year.

The inventory of available properties expanded, with months of inventory growing from a 2.5-month supply in February of the previous year to 3.4 months. Despite this growth, the current supply remains slightly below the 3.5-month supply observed in October and November 2023. Nationally, the housing inventory stands at a 3.0-month supply, as reported by the latest findings from the National Association of Realtors (NAR). Typically, a balanced market falls within the 4.0 to 6.0-month supply range, indicating a state where neither buyer nor seller holds a significant advantage.

If you enjoyed this post, please consider sharing it with others. ![]()

items